New stock exchange to open in Beijing

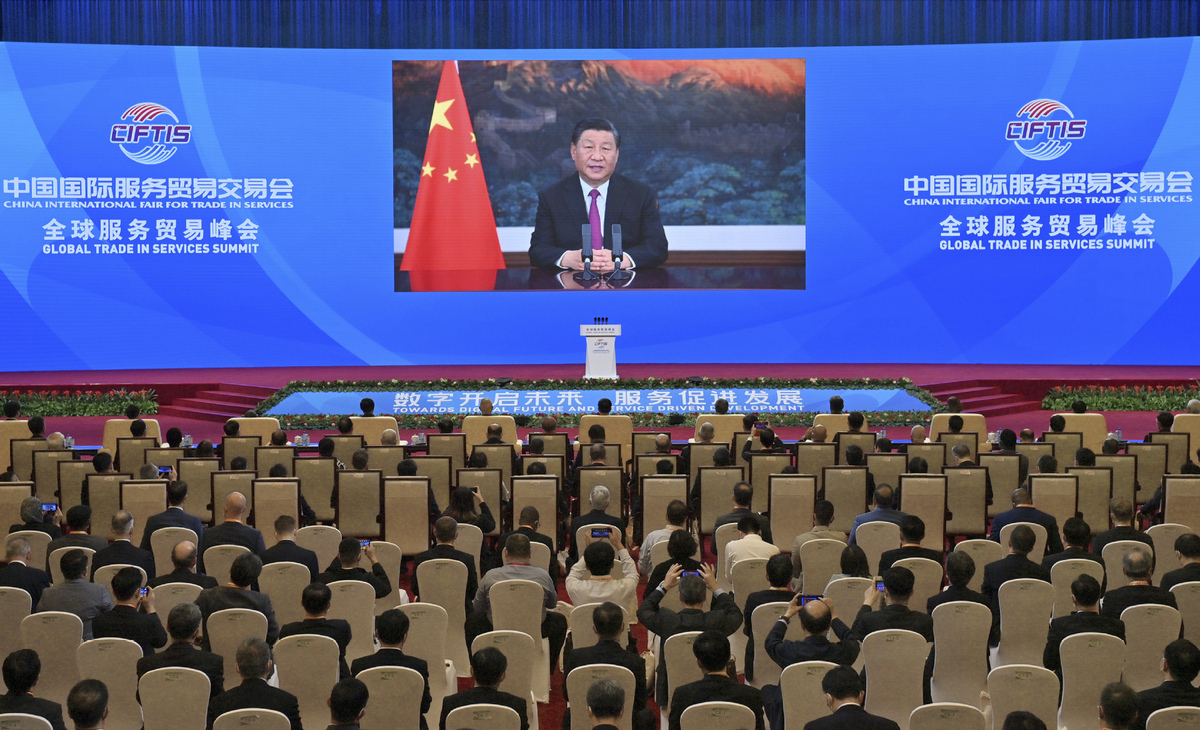

China will set up a stock exchange in Beijing and build it into a major base for serving innovative small and medium-sized enterprises, President Xi Jinping announced on Thursday.

Xi made the remark when delivering a speech via video at the Global Trade in Services Summit of the 2021 China International Fair for Trade in Services.

The China Securities Regulatory Commission, the country's top securities regulator, said the establishment of the Beijing stock exchange will serve as a major strategic step for China to build the new development paradigm and promote high-quality development.

"It will be a significant push for improving capital market functions, promoting the integration of technology and capital, and supporting the innovative development of SMEs," the CSRC said in a statement on Thursday.

The NEEQ Select, the highest tier of the National Equities Exchange and Quotations system, will be upgraded into the Beijing stock exchange, retain its basic rules and pilot the registration-based public offering system, the commission said.

The NEEQ system, which debuted in 2013 and is also called the "new third board", is an equity trading system tailored for SMEs.

A capital market system tailor-made for innovative SMEs will be established at the Beijing stock exchange, with the objective of nurturing an array of SMEs specializing in niche sectors and boasting a strong innovative capacity, according to the commission.

Li Jianjun, deputy head of the research institute of Shanghai United Assets And Equity Exchange, said the new exchange is expected to not only provide more financing opportunities to Chinese SMEs but also help to integrate different parts of China's capital market.

Innovative SMEs are likely to be allowed to go public on the Beijing exchange first and then transfer their listing venue to Shanghai or Shenzhen when they mature, Li said.

- Xi's discourses on work related to women, children, families published in English

- Global scientists discuss the role of big data in advancing UN goals

- Ferry routes and schools closed as Typhoon Tapah nears Guangdong

- Xi to attend BRICS leaders virtual meeting

- China activates emergency flood control response in Guangdong, Guangxi

- Australian expert lauds China as a global leader in nanoscience